who pays sales tax when selling a car privately in ny

As this article indicated if youre not making any profit out of your used vehicle by comparing its original value to the selling value you dont need to pay any tax returns. The buyer must pay 95 to the Secretary of State and a tax to the Department of Revenue.

New York Vehicle Sales Tax Fees Calculator

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

. However you do not pay that tax to the car dealer or individual selling the. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. The buyer must sign the bill of sale even if it is a gift pay sales tax or have proof of an exemption register and title the vehicle or trailer or snowmobile boat moped or ATV or transfer a.

Whether the car is purchased used or new. If you buy a car in New Jersey then youll need to pay sales tax and other fees when you transfer ownership. However if you sell it for a profit higher than the original purchase price or what is called a capital gain you must report the windfall on your income tax return and pay taxes on it.

The buyer will have to pay the sales tax when they. You dont need to worry about paying sales tax at this pointyoull pay that when you register and title the car at the DMV. Private sales are also subject to the 4 state sales tax.

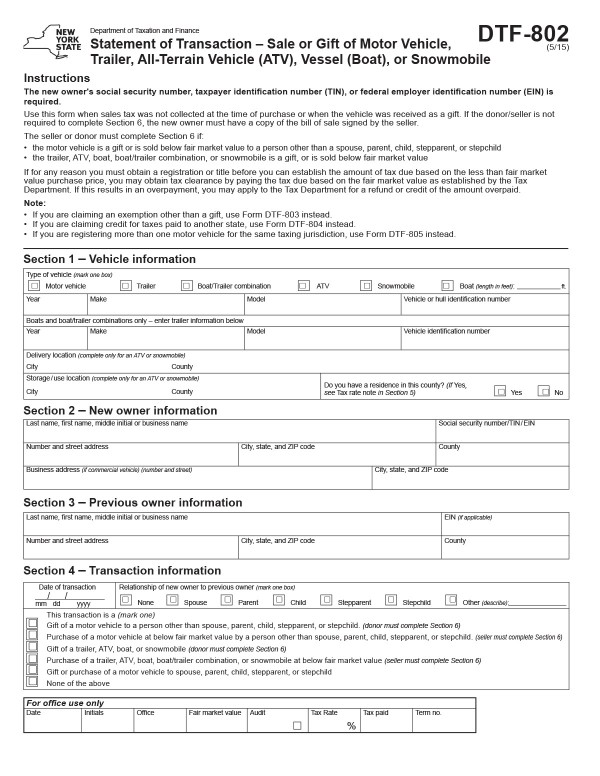

When a vehicle is sold in a private sale both the buyer and the seller must fill out a Statement of Transaction form DTF-802 which is then submitted to the New York DMV where the sales tax is. The IRS considers all personal vehicles capital assets. Effective September 1 2022 new taxes are imposed on the gross receipts paid by a shared vehicle driver for use of a shared vehicle under a peer-to-peer car sharing program in New York.

Nov 3 2022 2 min read. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. Once you have purchased the vehicle from a private party you are responsible for paying the state sales tax to the New.

For example sales tax in Naperville is 775 and 875 in Joliet. The buyer will have to pay the sales tax when they. If NY State sales tax was paid to a NY State dealer the DMV does not collect sales tax when you apply for a vehicle registration and the DMV does not issue a sales tax receipt.

In some places a use tax applies. Examine the title carefully for information about unsatisfied liens. So if you bought the car.

Depending on where you live when you buy a used car from a private party you most likely will be responsible for sales tax. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625 percent on the.

For vehicles worth less than 15000 the tax is based on the age of the vehicle. The buyer will have to pay the sales tax when they. In the vast majority of circumstances selling your old car to a private party or to a dealer shouldnt bring a tax bill with it.

Additionally sales tax varies from city to city in Illinois.

This Is The Legal Way To Avoid Paying Sales Tax On A Used Car

New York Dmv Chapter 3 Owning A Vehicle

All About New York Bills Of Sale Forms You Need Facts To Know

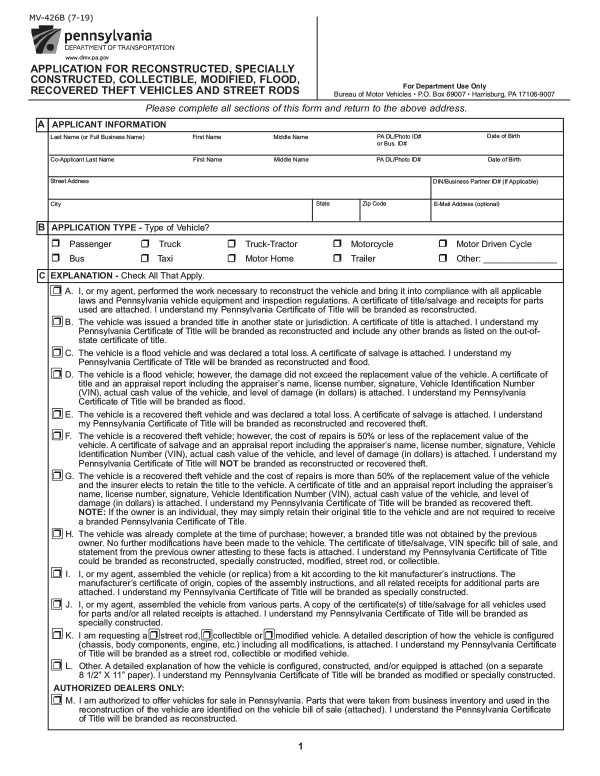

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

Using A Vehicle Bill Of Sale Legalzoom

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

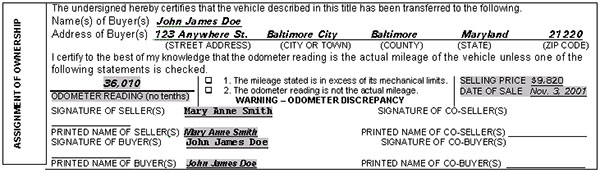

Buying A Vehicle In Maryland Pages

New York Sales Tax Everything You Need To Know Smartasset

How To Avoid Paying Car Sales Tax The Legal Way Find The Best Car Price

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

Understanding California S Sales Tax

Selling To A Dealer Taxes And Other Considerations News Cars Com

How To Close A Private Car Sale Edmunds

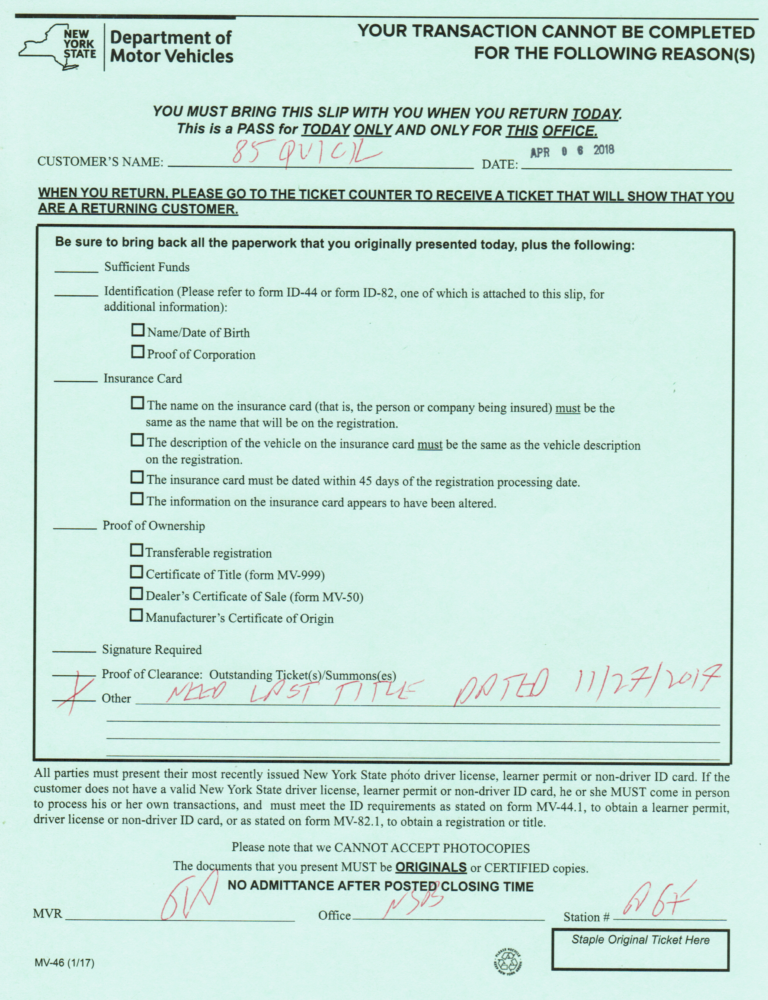

How To Buy A Car From A Private Seller In New York State 85quick Dmv Services

Buying A Car In Pennsylvania If You Live In Ny Protect My Car

Understanding Taxes When Buying And Selling A Car Cargurus

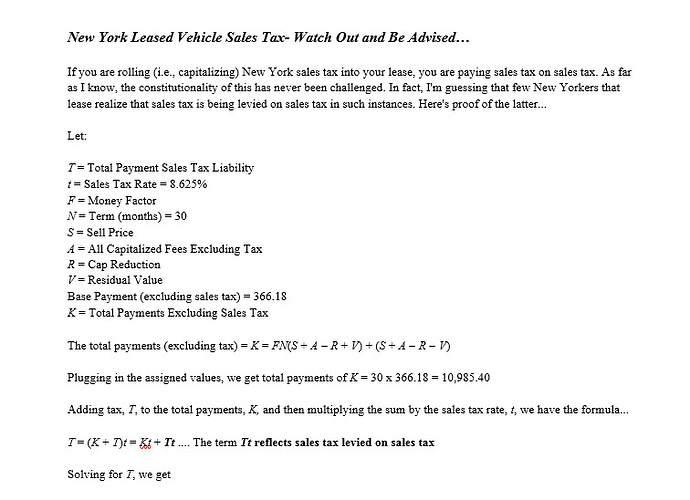

Sales Tax In Ny Off Ramp Forum Leasehackr

How To Write A Contract For Selling Your Car Yourmechanic Advice

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma